How banks are making their processes more efficient thanks to AI and modern workflows!

In today's financial world, customers expect fast and smooth processes, especially when it comes to lending. However, what consumers take for granted poses considerable challenges for banks and financial institutions that need to prove a wide variety of documents (pay slips, ID cards, contracts, etc.) must be checked quickly and accurately.

The challenge

When applying for a loan, banks receive a large amount of documents, often including proof of income. These documents vary in form, quality, and structure, with some containing scans, photos, and formats that are difficult to read. Manual verification is not only time-consuming but also prone to errors. This leads to longer processing times and declining customer satisfaction.

Faced with this situation, our client was looking for a solution that would allow them to quickly and automatically verify the information contained in the payrolls.

A solução: módulos CIB de Inteligência Artificial e gestão de pedidos escalável

For this application, CIB provided an integrated solution that combines several components:

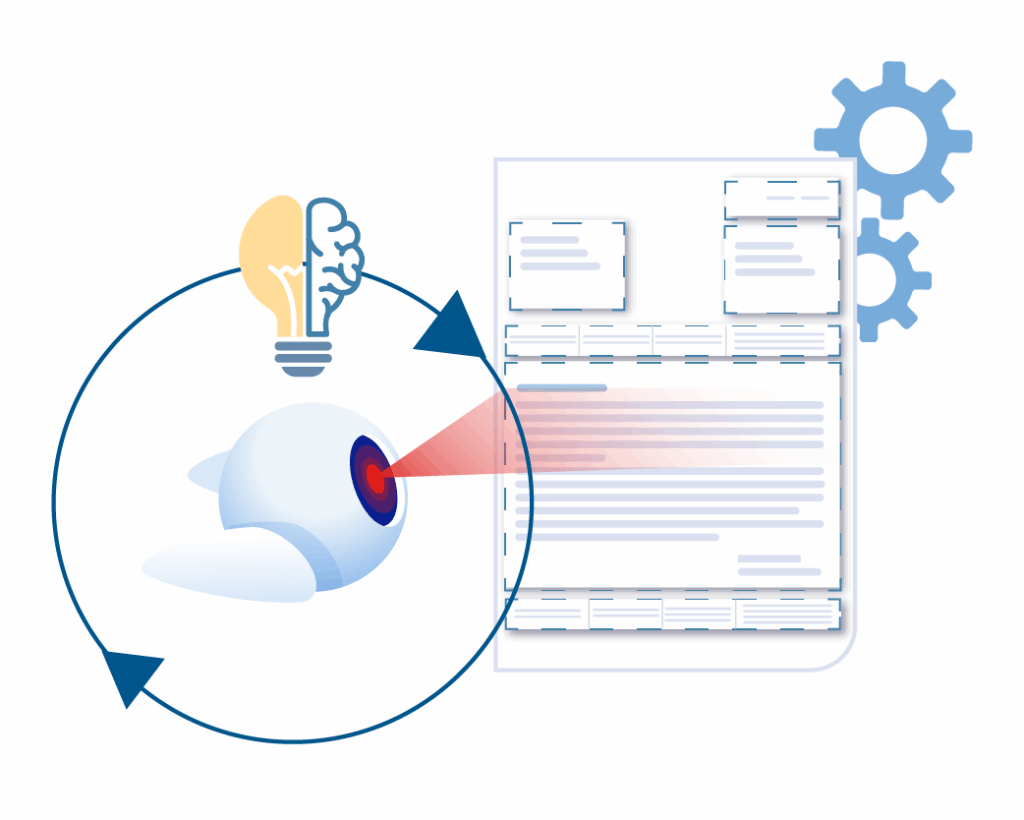

- The AI module CIB deepER automatically extracts relevant salary data even when scan quality is poor—using OCR technology, anchor words, and transformation methods.

- With CIB recogNice, documents are automatically classified – with an impressive recognition rate of 99%.

- CIB sherlock covers so-called dark processing (automatic processing without manual intervention) at a rate of around 80%.

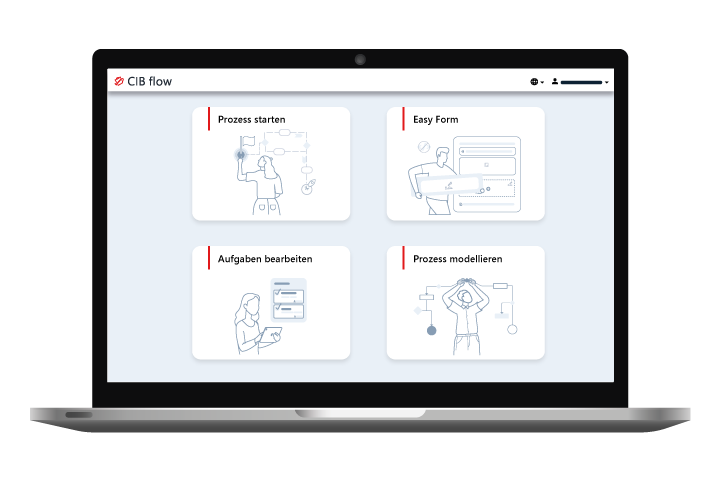

- Through the BPMN workflow platform CIB flow, these AI results are continuously integrated into automated processes.

Results at a glance

Thanks to this AI and automation solution, the bank has already achieved the following successes:

- A document classification with a very high hit rate (~99%).

- A dark processing rate of around 80% – this means that 80% of processes run automatically, without manual intervention!

This leads to massive time savings and increased efficiency in the payroll verification process. At the same time, customer satisfaction increases significantly, while operational costs decrease.

99% AI hit rate 80% in dark processing

Why does it work so well?

Heterogeneous documents

The solution takes scans, photos, and poor legibility into account thanks to robust OCR and AI models.

Automation instead of manual checking:

Classification and extraction eliminate many manual steps.

Transparent workflow

Integration into BPMN processes enables the monitoring, control, and optimization of processes.

Scalability

The platform automatically scales processing capacities upwards – ideal for high case volumes.

“Currently, 11.5 million pages per year are calculated to be processed. The bank plans to reduce throughput times through this process. This should increase the settlement rate by at least 10% per year.”

Sascha Proske, CIB consultant and Project Manager

Implications for banks and financial institutions

- Processes must not only be digitized, but also intelligently automated. The focus is shifting from “digitization” to “automation and optimization.”

- AI modules not only enable efficiency, but also higher quality (fewer errors, better data).

- Today's customers expect speed and clarity. Delays have a negative impact.

- Transparency and control of processes are crucial to achieving high automation rates.

Conclusion

The case study illustrates how banks can use AI and automation to streamline their credit assessment processes, particularly when verifying proof of income. The combination of document classification, data extraction, and workflow integration enables faster, more accurate, and scalable workflows. This gives financial institutions a clear competitive advantage.

Talk to us!

If you are considering how to optimize your testing processes, this solution offers a concrete starting point: Digitalization alone is not enough—automation and AI make the difference. We offer personalized advice!