The 3. CIB User Group, in which 50 banks, including private banks and cooperative banks, took part, ended last Wednesday in Berlin. We were particularly pleased that several banks that had already participated in the 2023 and 2024 User Groups were back again this year. We were also able to welcome many new banks. As a result, our community is growing and now numbers around 86 German banks!

Four of our partner companies ATRUVIA, Trinext, DG nexolution and Bank-Verlag also took the opportunity to participate. A sign that our user group also offers an attractive environment for them.

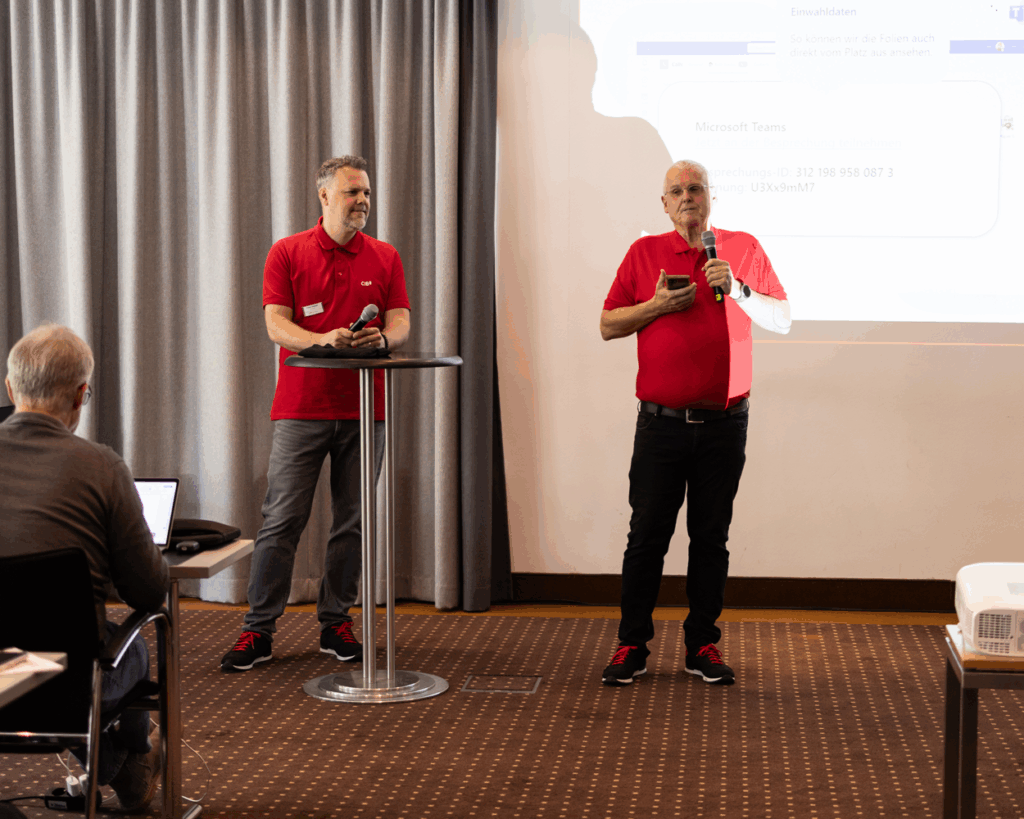

CIB founder and host Ulrich Brandner,r and Managing Director Frank Seboldt opened the event and announced an exciting mix of topics, with innovations, specific use cases, and also a good portion of tips and tricks for users' day-to-day work.

Common goals

The first day was all about the Barrier-Free German Accessibility Reinforcement Act (BFSG). Many German banks have been focusing on this topic for some time now, as the end of the transition period is approaching on June 28. In his presentation, CIB consultant Sascha Proske made it clear that banks would do well to see the BFSG as more than just an annoying act of compliance.

"In the light of day, institutions have the opportunity to make financial products accessible to people with disabilities." "Digital participation is essential for society," said Proske, an idea that was met with approval by the participants. Banks could also cut costs through accessibility. After all, every call to the hotline or support team incurs expenses.

Proske recommended thinking outside the box when it comes to accessibility. Accessibility isn't just about visual impairments. Using a car loan agreement as an example, he demonstrated what is possible beyond that. First, he translated a complicated contract clause into plain language and then turned it into a podcast.

Achieving universal accessibility with PDF/UA

As a first step towards accessibility, Sascha Proske named the PDF/UA standard for forms and templates, where UA stands for “universal accessibility”. Accessibility is achieved with PDF/UA primarily through structuring and alternative texts.

CIB supports banks with a package of services ranging from the analysis of existing templates and the identification of weak points to the creation of accessible documents.

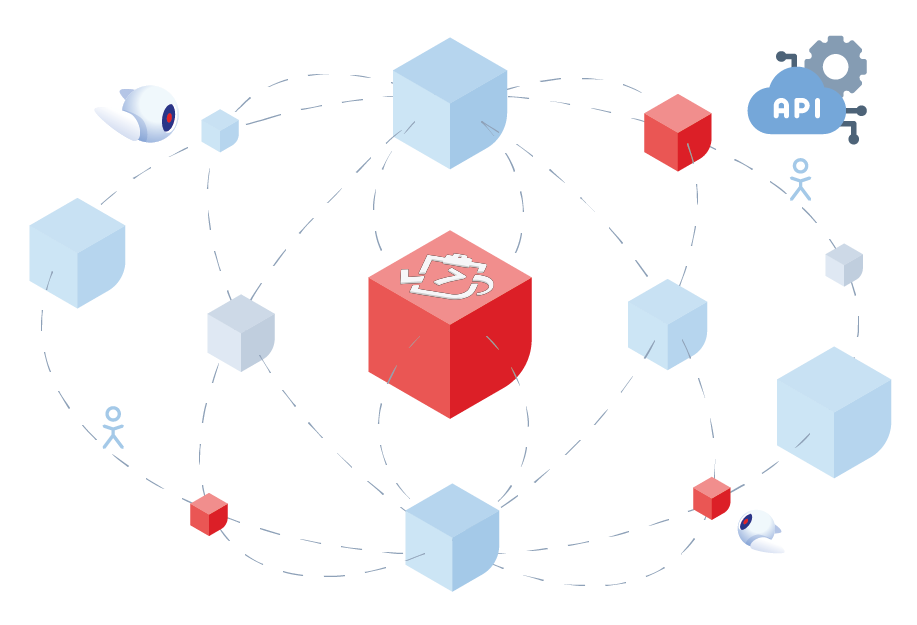

Intelligent document classification as a prerequisite for dark processing

CIB Automation Consultant Vincent Roth had taken on another exciting topic, and not just for banks - the dark processing of documents. This refers to the automatic processing of documents without human intervention, which can reduce the workload, especially in times of a shortage of skilled workers.

The concept consists of four steps: After the various input channels for documents are bundled, they are classified by assigning a document type. This is a prerequisite for the KI-gestützte Datenextraktion. Finally, this data is fed into a business process that has been modeled with the business process management tool CIB flow and docked to the target systems, for example, the core banking system, via interfaces.

For the automated creation of PDF/UA documents in background processing, you can read more in the blog article.

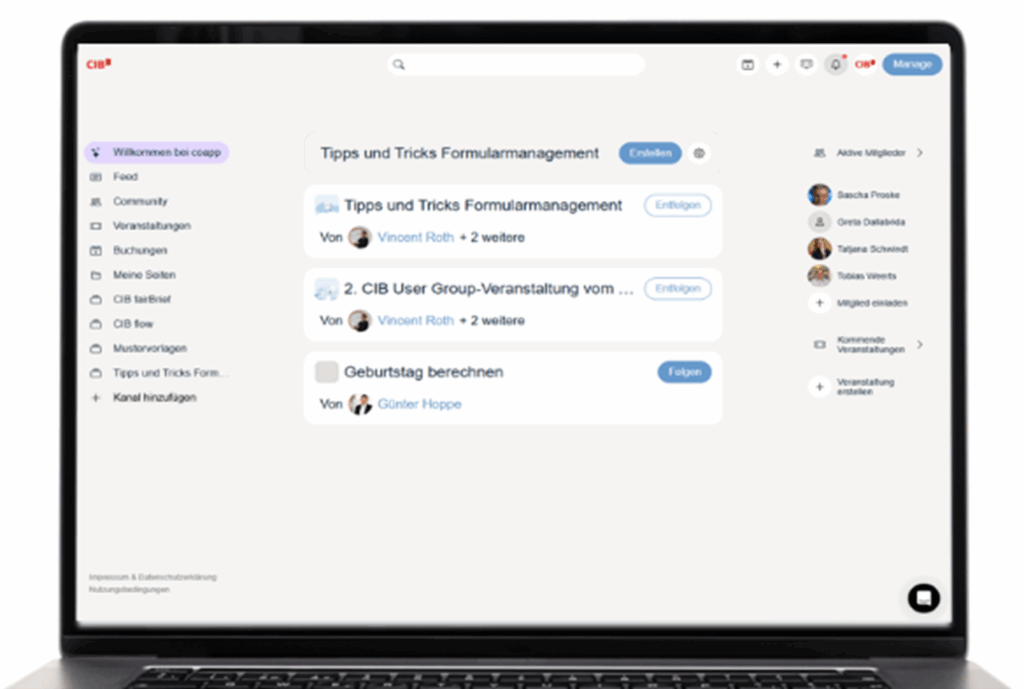

An online forum for the User Group

The Community Tool was also introduced, and all interested participants and community members are invited to register and get involved. Over 100 members have already signed up.

This also provides the group with an online forum for exchanging information between the annual User Group meetings. The platform is used, among other things, to share tips and tricks and, in the future, also for custom forms and bank templates.

Tipps & Tricks und Best Practices

Already during our first and second CIB User Group for banks, the "Tips & Tricks" session was a great success! Of course, we once again brought along a large package of small and large tips, tricks, and best practices for text programming. Participants were able to deepen their knowledge in using CIB workbench and CIB coSys, our specialized text organization tool with template management, and also discuss specific challenges together.

One-on-one exchange with the CIB World Café

Nextfolder® and bank-specific processes.

Our partner Jan Andresen (TriNext GmbH) once again presented Nextfolder® this year—a solution for process-oriented, paperless handling of incoming documents for banks, linking operational processing with long-term legal archiving. A powerful solution in combination with our automation tool CIB flow!

Advantages of centralized letter distribution with Atruvia

Dragan Klein (Atruvia AG) apresentou em detalhe as novidades do layout central de cartas. Naturalmente, durante a discussão que se seguiu, o Dragan pôde partilhar várias dicas úteis e indicar rapidamente as fontes de informação relevantes, demonstrando-as também ao vivo.

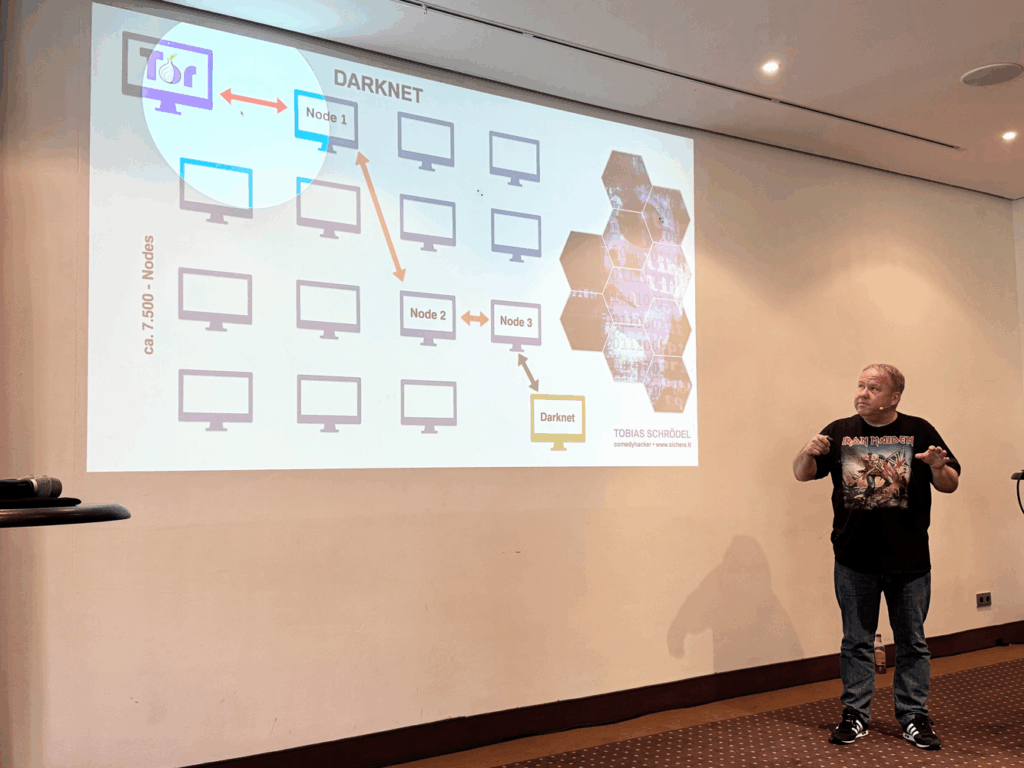

Technical know-how with humor

Tobias Schrödel, Germany’s most well-known IT comedian, was our guest and delivered thrilling entertainment and fascinating insights into the world of cybercrime. With his engaging live performance “Cybercriminals on the Darknet: Ransomware and How Our Data Ends Up Online,” he not only made the audience laugh but also raised awareness about the dangers and mechanisms of modern cyberattacks.

We asked the participants for feedback

During the event, we interviewed participants, such as Katharina Schulze, an employee at Volksbank Raiffeisenbank in Itzehoe:

“We’re not alone but connected through the CIB User Group. I can ask questions from anywhere, get help everywhere, and now I have a big community thanks to this User Group — and that’s the biggest benefit I’m taking home.”

Daniel Jacobi from Volksbank Backnang also took part in the interview. He is pleased with the successful event and the tips and tricks he took away.

“I’m taking home an important tip for myself and my colleagues: how we can test the accessibility of forms in CIB workbench. This will save us a lot of work time!”

CIB hospitality in beautiful spring weather

As is tradition at all CIB events, socializing was not neglected this time either. Generous breaks for networking and professional exchange, along with varied catering, created a relaxed atmosphere and perfectly rounded off the event.

A big thank you to all participants

We sincerely thank everyone who participated in and contributed to the 3. CIB User Group for Banks, for the many interesting insights and for enriching our community!

A User Group with real added value

The CIB User Group has created a dedicated community of bank organizers and digitalization experts who look together toward the future of bank management. We are at your side as a software manufacturer for your standard document management applications.

We are already looking forward to the next meeting in 2026 and say: Achieve a lot together! Become part of our committed community: