Banks today face the challenge of meeting the high demands of banking customers for user-friendly end-to-end processes and fast turnaround times. At the same time, they have to contend with regulatory requirements, the effects of the skills shortage and bureaucratic hurdles.

These challenges can only be overcome through effective standardization, digitalization, and automation of business processes. Conventional approaches encounter a variety of problems such as the need for programming skills, low flexibility, limited scalability, and high documentation costs.

Our innovative workflow management and task automation platform CIB flow offers the solution to these problems.

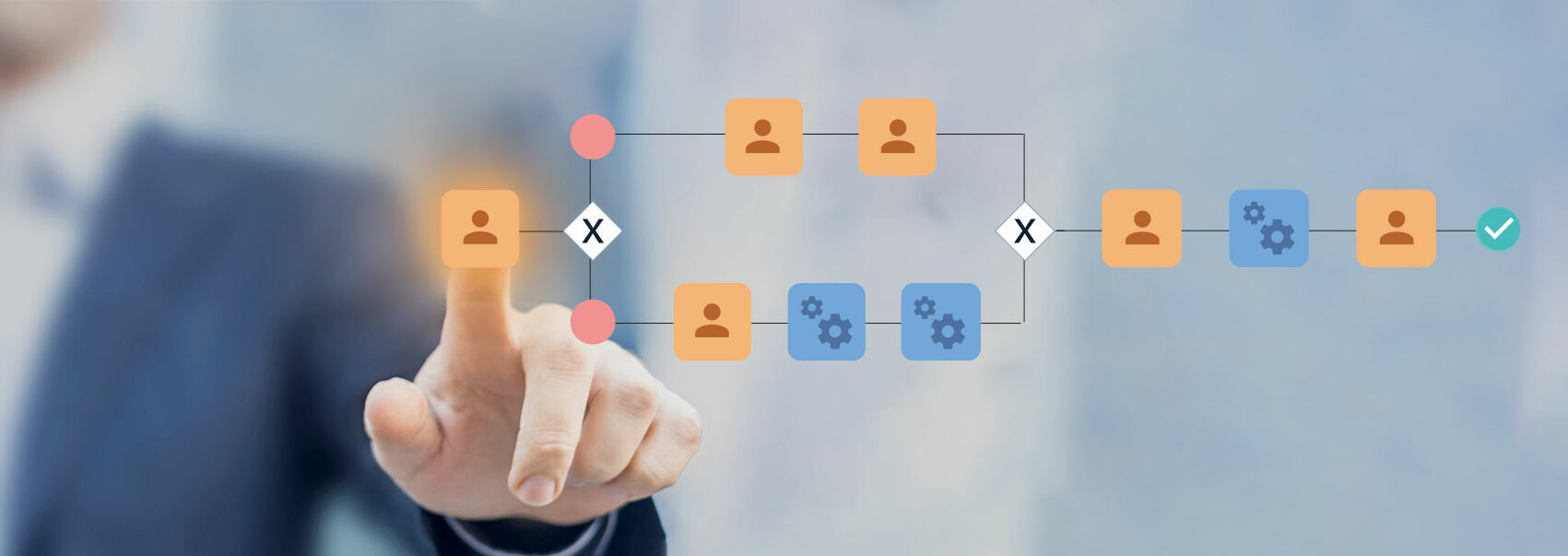

Just more efficient with BPMN 2.0 and Low Code

CIB flow uses BPMN 2.0 and low-code technology by means of predefined modules as well as a form construction kit for creating dynamic user forms.

The platform makes it possible to digitalize and automatize everything from tasks to the most complex processes without the need for in-depth programming knowledge.

Flexibility and high reactivity

In the banking environment, requirements often change very quickly. CIB flow enables ad-hoc changes in process design without complex programming. Employees can make adjustments in real time and independently of software releases.

Process and user management provides information on current and completed workflows and enables the audit-proof assignment of responsibilities.

Digitization of internal bank processes

In addition to the processes from the core business, support intern processes can also be mapped in CIB flow.

From workflows from personnel administration, such as sick leave or travel expense accounting, to procurement and regulatory processes such as supervisory business processes, including the involvement and, if necessary, approval of various bodies.

Minimization of documentation work

Process modeling combines the visualization and executability of workflows. This considerably reduces the documentation effort. Process steps are documented in a transparent and comprehensible way, which not only facilitates compliance with regulations, but also speeds up problem solving.

With CIB flow, financial institutions can efficiently digitalize and automatize banking processes.

Thanks to the three pillars of workflow design with user-friendly interfaces, banks can respond quickly to business requirements and

- increase their efficiency,

- react quickly to regulatory requirements,

- automate work processes easily,

- act with legal certainty.

Automate easily with CIB flow!

CIB flow is a stand-alone web application that requires no installation. Your company can start to automate processes immediately without having to worry about complex IT infrastructures or long implementation times.

Visit our case study and find out how we supported PSD Bank in Nuremberg. Contact us for a consultation!